Need help with the spreadsheets?

Post your question into our Google group. Add a link to the page where you got the spreadsheet from, so that others might find it later.

Trading Plan is a pre-requisite to trading and it is one of the most important things for a trader. The same thing applies whether you are day trading, scalping or swing trading. You need to have a proper plan or strategy in place before you can get into the market.

Long-term investors might argue that for them a trading plan does not matter, but it does actually help to have a written plan even for buy & hold. What it does is that during times of high volatility, the investor can simply go and read the trade plan instead of panic selling on the unchecked emotion.

What should a good trading plan have?

For a single trade:

- initial risked amount

- market & timeframe

- entry price or trigger (such as MA crossover)

- exit price or trigger, if not stop loss

- initial stop loss position

- rules for stop loss moves

If you want to do the whole philosophical thing, there are some nice to haves to keep in your trading plans. These do not change that often, but it’s good to have them on hand:

- your overall trading goals

- your timeframes of focus for each market and season, with some reasoning

- list of pre-trade activities (quick analysis for bias etc)

- a few different ways of pre-market analysis (charts, news, social media)

The more knowledge you have about the markets before you take the plunge, the higher are your chances of success. That’s why it is better to include a short analysis session before you start trading. That way, you will have a better understanding of the market and your trades.

Good trading plan is a work in progress

Trading plan is a pretty personal thing and as such should not be something that is written overnight.

It might take weeks or months for you to develop a trading plan that fits your style. It might even forever be a work in progress - market conditions change, your goals change, you know the drill.

As such, it is better to start with a really simple Word or Excel trade plan template. Something that just has the absolute basics and a lot of space for personalisation.

I’ll link the two templates just below.

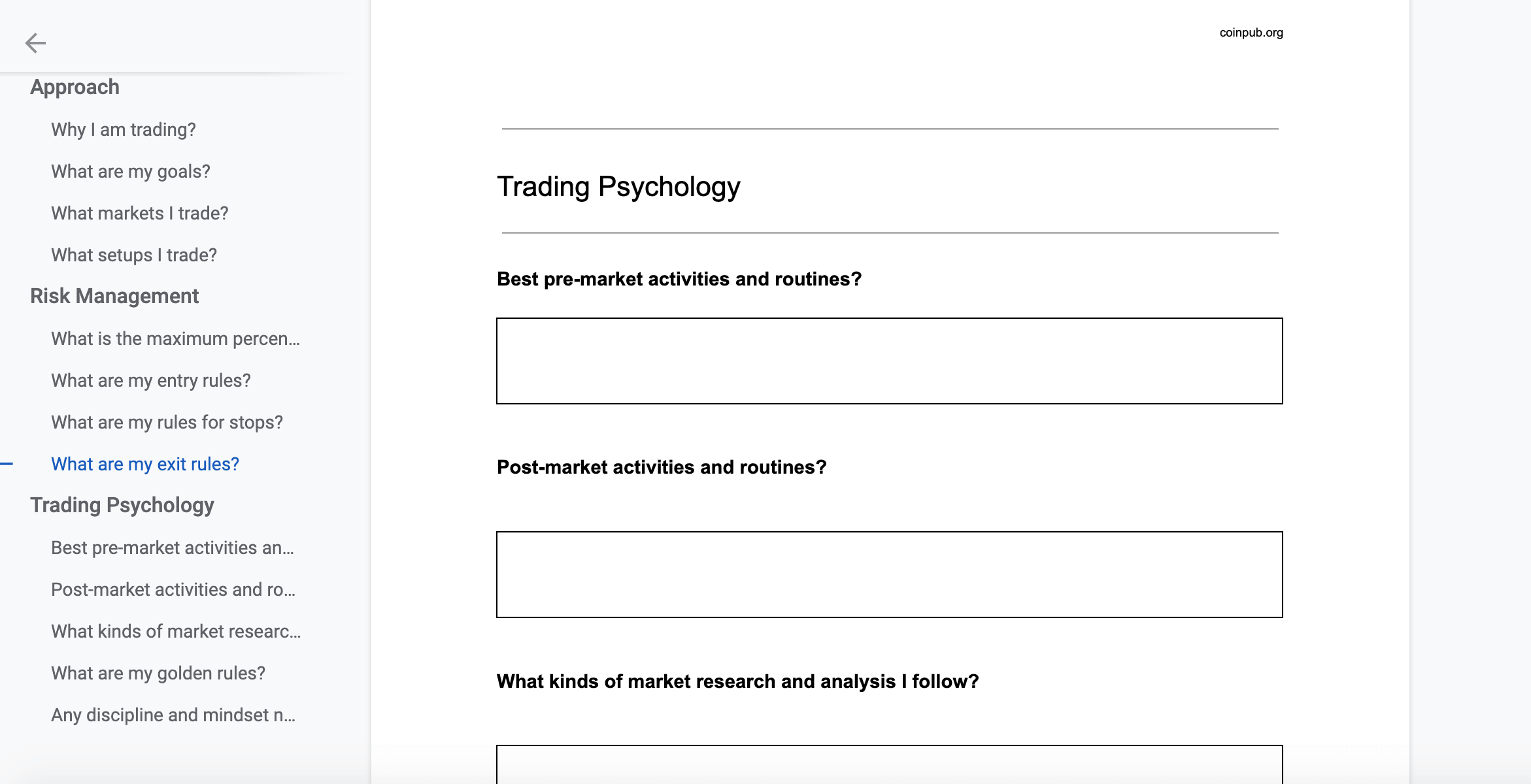

Trading Plan for Word (via Google Docs): Get it here

First template is a document (Word or Google Docs) that represents the “philosophical” trading plan idea. You can fill it in once a quarter or once a year, depends on how fast you are moving on. Don’t discard it when you’re done with it, over time it will be a good learning material.

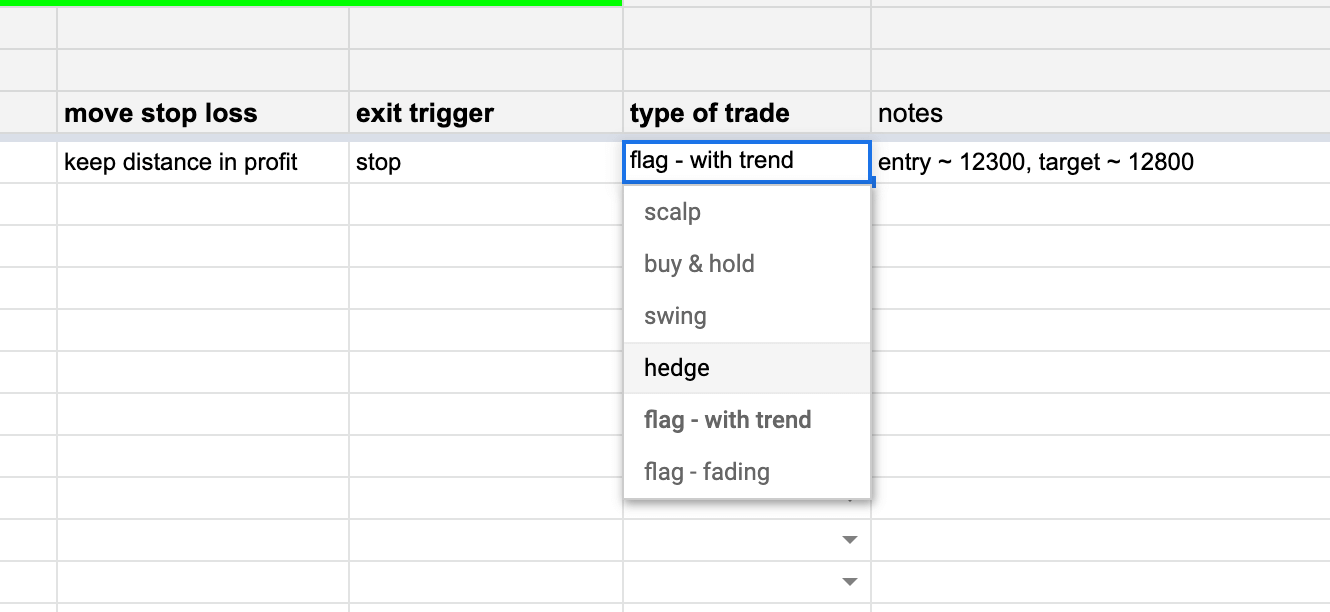

Trading Plan for Excel (via Google Sheets): Get it here

Second is a spreadsheet for planning your trades. This is handy for the weekends or whenever it is you are looking at the markets, assessing the moods and the fragilities against the value of your portfolio.

If you want to start from scratch?

The following are some of the important points that you need to consider when developing your trading plan:

1. Know your goals

Before you start planning to trade, you need to know what you want to achieve from it. Whether you want to make money or just want to trade for fun, knowing your goal will help you focus on the right things.

2. Know your risk tolerance

Another important thing to consider is your risk tolerance. How much money are you willing to lose in a day? In a week? Knowing this will help you set appropriate stop losses and take profits.

3. Have a trading system

A trading system or style is a set of principles that you follow each time before you get into the market. This ensures consistency and improves your chances of success.

It also gives you the information to put down in your trading plan, by the way.

It’s ok if you don’t have one - follow any standard setup and use a stop loss. That will minimize your risk and in time you will find a good fit.

A trading system gives you a set of guidelines on what to do, when to buy/sell and how much money can be made or lost.

An effective trading system should include the following:

- Entry rules: These are the conditions that must be met before you enter a trade.

- Exit rules: These are the conditions that will trigger you to exit a trade.

- Position sizing: This is how much money you will risk on each trade.

- Money management: This is how you will manage your account’s risk.

- Trading psychology: This is how you will handle your emotions while trading.

4. Write a trading plan

A trading plan is a written document that outlines your trading system. It should include the following:

- The markets you are going to trade

- The time frames you are going to trade

- Your entry rules

- Your exit rules

- How much you are going to risk on each trade

- The maximum number of trades you will take per day/week.

Having a written trading plan helps you both to develop a trading system and follow it consistently.

With the trading plan, you will be able to test if your trading system works or not. You can also use it as a guide when you actually start trading live.

Summary

There is a bunch of benefits to having a written trading plan. It helps you to trade with a system, which improves your chances of success. You will know exactly what you are going to do in a trade.

It helps you develop your trading psychology and become a good trader. It keeps you disciplined, as you will have rules to follow each time before you enter the market.

You can use it as a reference when things go wrong. It helps you learn faster, as mistakes will be documented.

When you have a trading plan that’s constantly being tested, it becomes easier to constantly improve on it.