Need help with the spreadsheets?

Post your question into our Google group. Add a link to the page where you got the spreadsheet from, so that others might find it later.

(jump directly to spreadsheet)

When somebody says arbitrage trading, they can mean several different trading methods.

What all the methods have in common is that they generate profit independently on the directional movement of the markets.

To achieve this profit that is independent on the direction of price action, you need to make a trade on two (or more) different markets.

Crypto arbitrage

This website is partial to cryptocurrency trading, and so on crypto markets arbing, or arbitrage, often refers to trading the same pair but on different exchanges.

We’ll first go through all the different types of arbitrage trades that people do in crypto and explain why you do or don’t need a spreadsheet for them.

P2P arbitrage

The classic example of this would be buying BTC or ETH on Coinbase and selling it on LocalCryptos with the usual 1-5% markup.

Some technicalities must be involved to make sure you don’t in fact lose money when the market moves: Your LocalCryptos account needs to be loaded with BTC so that you don’t need to wait for the deposit from Coinbase to finalize a trade.

You don’t need a spreadsheet for P2P arb. The trick is just in P2P trading from a stack but immediately buy the coins back on a cheaper exchange.

Triangular Arbitrage

A more high-tech example is arbitraging altcoins. Alt coin traders sometimes call this the triangular arbitrage.

Triangular arbitrage earns money on mis-pricing of alt coins paired with different currencies. Lets say, you would run your money through the following markets and end up with more USD than you started with:

- USD to ETH

- ETH to JPY

- JPY to USD

You don’t need a spreadsheet for triangular arb. As any opportunity that leverages inefficiency in the market, this arb opportunity is short-lived. People generally automate this trade.

There are many scripts that detect triangular arb opportunities.

Geo arbitrage

Geo arbitrage is probably the least risky arb trade that exists, but it is not available to many people.

You can only geo-arb if you have double nationality or a permanent residency in a country where you were not born. This way you can gain access to relatively isolated markets, let’s say in South Korea or in India, as well as to the globally accessible markets on the big exchanges like Coinbase or Kraken.

The price on global exchanges is usually lower, crypto trades usually with a premium in countries like South Korea. So, you can be a seller in there, as long as you are able to withdraw money from there.

No need for a spreadsheet here, either. It’s the same thing as with P2P arb.

Futures and options arb and yield trades

Here we are finally getting to the type of arb where you probably do need a spreadsheet.

Arbing derivatives involves too many variables for anyone to get the exact figures just by looking.

At the same time, the premiums in prices of derivative products over spot (positive or negative) reflect a long-term sentiment of the traders on said markets. That means, while you can automate this trade if you want to, some premium is likely to persist.

The opportunity becomes less profitable for everyone with more people using it (and automating it), but in most circumstances it will not vanish completely.

So, in the spreadsheet linked below we give you the calculators for your profit (before fees) from the two most popular non-directional trades in crypto that involve derivatives.

Cash and carry arbitrage

Cash and carry arbitrage makes non-directional profit by executing two trades in the opposite directions, one on a spot market and the other on a futures contract of the same pair.

You can execute cash’n’carry arb in either direction. In crypto, often the futures contract will be more expensive than spot. In this case you short the futures and long the spot.

It can also happen that the futures are below spot. This changes nothing except that you short spot and long futures.

The price difference is not due to markets being inefficient. Futures are more expensive if people on the markets have a bullish bias. This bias shows itself in that there will be quite some traders longing futures as a speculation on upcoming price increase. This activity drives the futures price up.

The opposite sentiment drives the futures price below spot.

Because the price of future vs spot reflects a wider sentiment, the opportunity for arbing it usually sticks around for longer.

However, as you will notice, the closer you are to the maturity of the futures, the lower the difference gets as more and more people execute the arb trade to get a quick buck.

On Weekly futures, there isn’t much of an opportunity anymore, but on Monthly there usually is. Even if it’s just a few percent, it will be better than the interest rate you could get from your bank.

Covered call

This is technically called a “yield trade” but the execution is so similar to cash and carry that it might as well be included here.

The trade takes advantage of the premium you earn when you sell an option. This premium gets to your account upfront and never leaves it, but if the market moves up, you will be forced to sell coin at the strike price which at that time will be below market.

That’s why you cover the sale of the call by buying the amount in question on spot. This will make sure you will earn money either way.

Cash-n-carry and Covered Call calculator spreadsheet

TO EDIT: Click “File” and “Make a Copy”

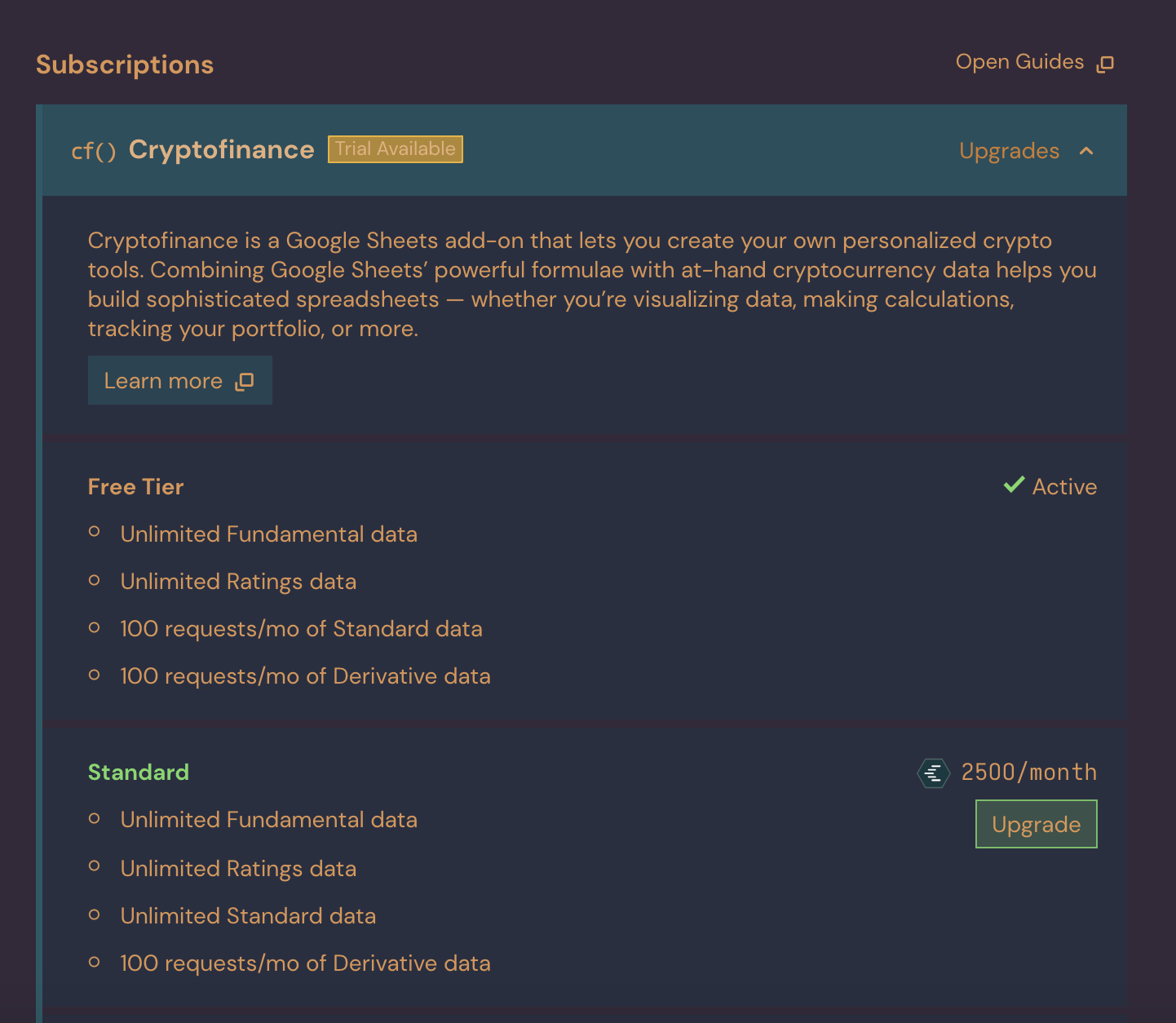

Final note: This is not included in the sheet above, but the well known crypto charting site CryptoWatch has an add-on for Google Sheets. It’s called CryptoFinance.

The add-on only works with a subscription at Cryptowatch, which comes at about 25 USD per month (that’s roughly the value of 2500 “credits”).

The sheet above does not feature CryptoFinance, you need to type in the price of your derivative manually.

If you trade a lot though, CryptoFinance will pay off.